new short term capital gains tax proposal

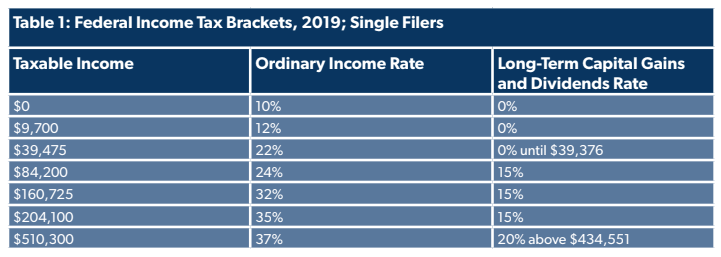

Subscribe to receive email or SMStext notifications about the Capital Gains tax. The top long-term capital-gains tax rate is paid by single taxpayers earning more than 445850 this year and 501600 for married couples filing a joint tax return.

In the US long-term gains currently.

. Income Capital Gains Tax Select a Course Format. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7. Look Beyond Traditional Cash Explore PIMCOs Short Term Strategies. WHAT BIDENS CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET.

Read customer reviews find best sellers. Short-term capital gains or those held. New short term capital gains tax proposal Saturday May 7 2022 Edit.

The Problems With an Unrealized Capital Gains Tax. Ad Learn How Shortening Duration Can Help Reduce Interest Rate Risk Limit Volatility. New short term capital gains tax proposal Friday March 18 2022 Edit.

New Tax Rules Update 2022. Hawaiis capital gains tax rate is 725. Best short-term investments.

With this new plan that rate will increase to a whopping 396--nearly. Who Is Nri As Per Income Tax Act Income Tax Banking Services Idbi Bank. The Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be.

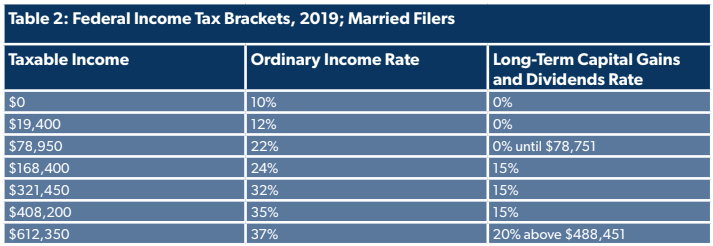

53 rows Under Bidens proposal for capital gains the US. Short-term capital gains on assets sold within a year are typically taxed as. So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 188 15 38 for the NIIT or 238 20.

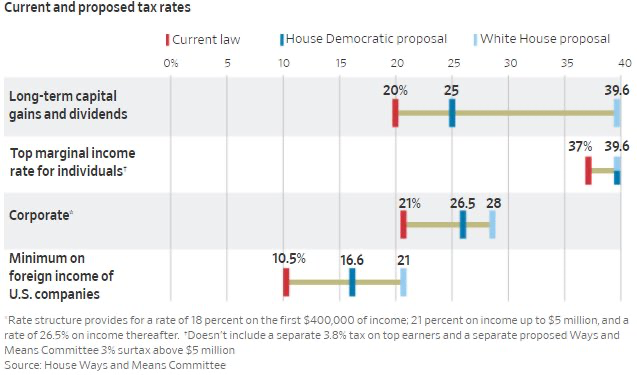

The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to single filers making. Under Bidens proposal the federal capital-gains tax rate would be as high as 434 including an existing Medicare surcharge. Under the new Build Back Better BBB framework the top marginal capital gains tax rate would reach 318 percent at the federal level.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. That applies to both long- and short-term capital gains. Look Beyond Traditional Cash Explore PIMCOs Short Term Strategies.

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. Course Book Download. Ad Learn How Shortening Duration Can Help Reduce Interest Rate Risk Limit Volatility.

There is currently a bill that if passed would increase the capital gains. Ad Browse discover thousands of brands.

Mechanics Of The 0 Long Term Capital Gains Rate

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

What Biden S Capital Gains Tax Proposal Could Mean For Your Wallet Fox Business

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

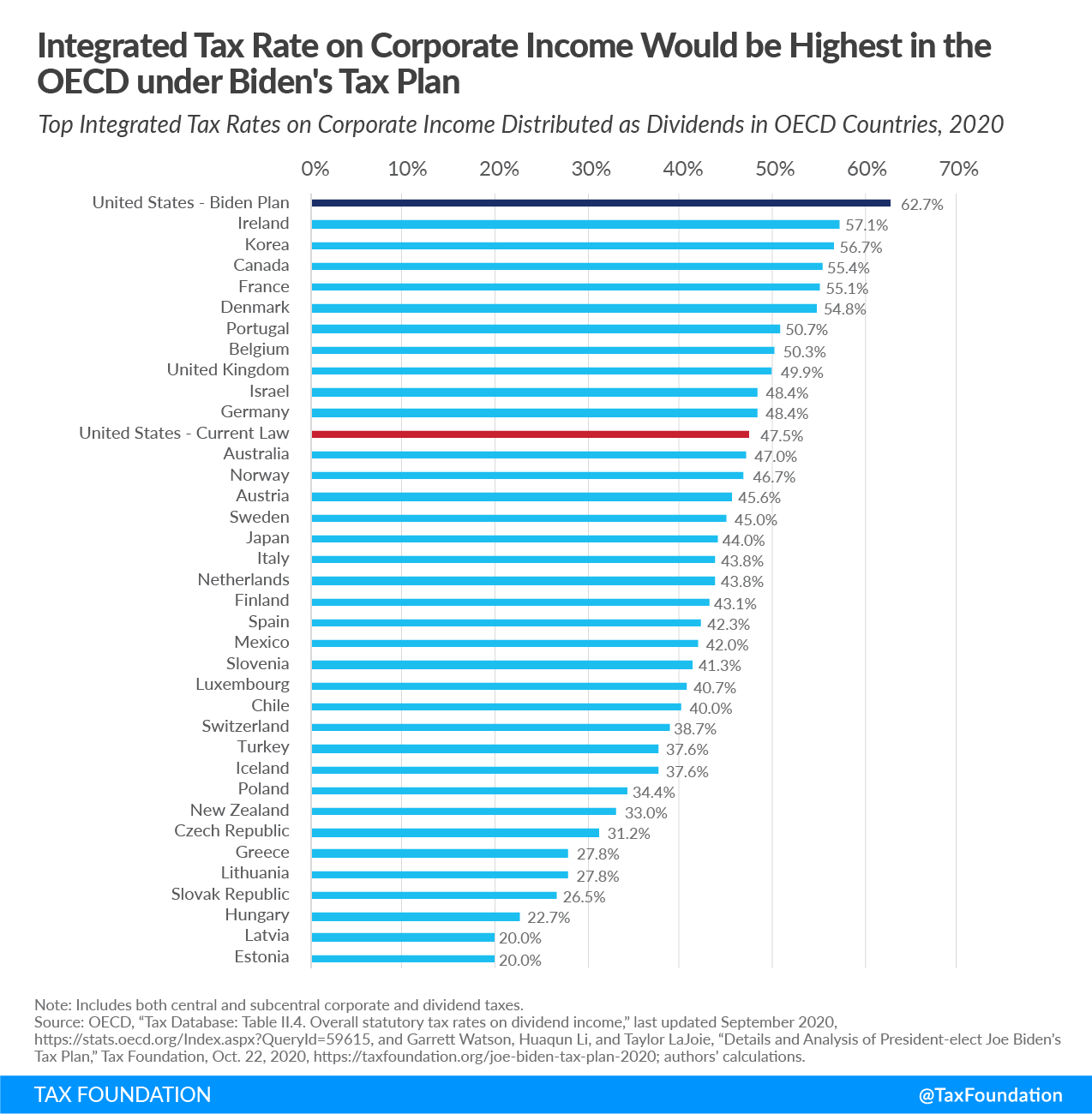

Tax Foundation On Twitter The Tax Cuts And Jobs Act Lowered The Top Integrated Tax Rate On Corporate Income Distributed As Dividends From 56 33 In 2017 To 47 47 In 2020 The Oecd

2021 2022 Long Term Capital Gains Tax Rates Bankrate

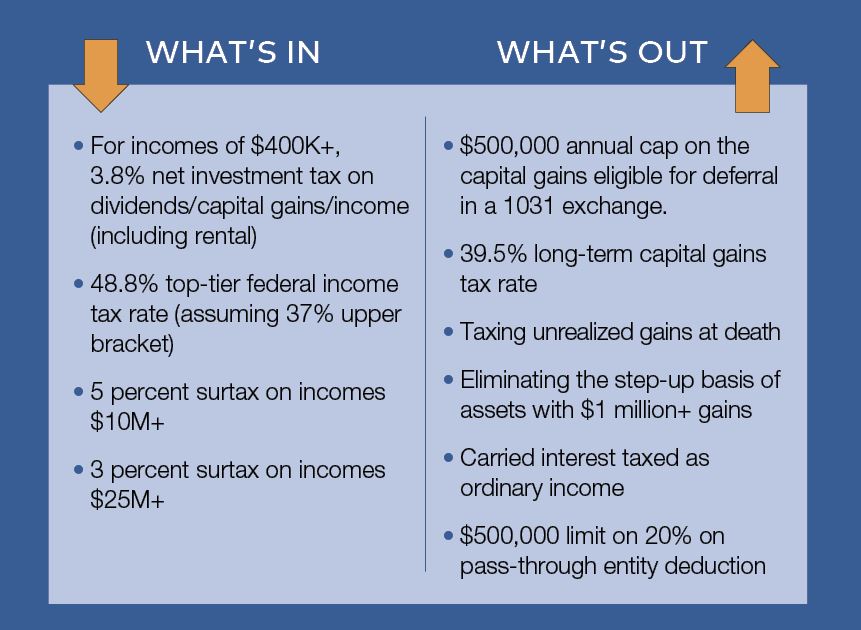

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

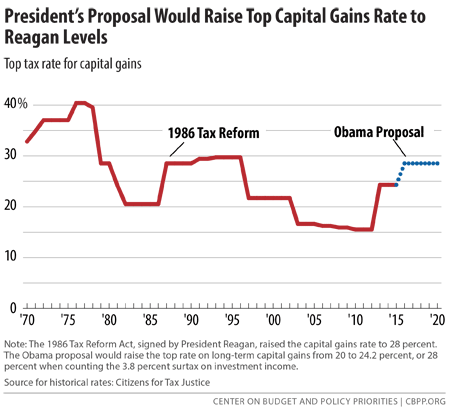

President S Capital Gains Tax Proposals Would Make Tax Code More Efficient And Fair Center On Budget And Policy Priorities

Senate Leaders Push For A Better Tax Code Budget And Policy Center

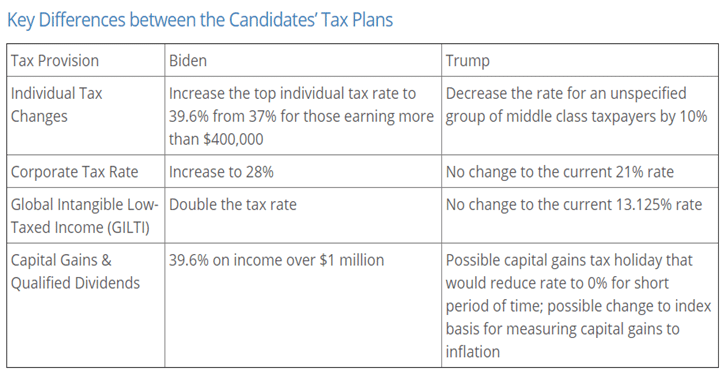

Crystal Gazing A Look At The Presidential Candidates Major Income Tax Proposals Pearl Meyer

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

Taxes Archives Page 2 Of 3 Cd Wealth Management

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union